Princess Cruises have considering USD step one Places on the 2022 & 2023 Voyages

Articles

The new Irs but not provides verified provides provided all the first and you can second Economic Effect Costs it’s legitimately permitted to issue, considering details about file for eligible someone. The brand new $1400 stimuli commission have a tendency to regarded as a sophisticated refundable borrowing up against your 2021 taxes. You won’t need to pay taxation in it, but could even be claimed on your 2021 go back because the a good data recovery promotion borrowing from the bank for those who don’t have it for some reason this current year.

Annualized Earnings Cost Means

Certain cost don’t qualify for a lot more incentive interest levels and are not available in conjunction which have all other added bonus or unique rate of interest give. To have Advance Observe Label Dumps, it pertains to funding regards to step 3, 4, six, 9, eleven and one year, as well as all identity lengths greater than 1 year. To own Label Places, so it applies to funding terms of step three, six, 9 and you will 1 year along with all the label lengths out of more than 1 year.

Ally Checking account

Box step 1 will teach the degree of unemployment payment you have on the season. Container 4 will show the level of federal tax withheld, if any. You need to tend to have tax withheld from retirement otherwise annuity pros introduced away from Us. However, when you’re an excellent You.S. citizen or resident alien, you can choose to not have taxation withheld for individuals who render the new payer of your own benefits a property target on the United Says or perhaps in a U.S. area. The new payer need keep back taxation for those who give a good You.S. address to possess a nominee, trustee, otherwise agent in order to just who the advantages can be delivered, however, wear’t provide your property address in the usa otherwise in the a good U.S. region.

Find When to Spend Projected Tax and ways to Shape For each and every Payment , later on. To work your own asked energy taxation borrowing from the bank, don’t were electricity tax for the first step three household of the season which you expect to have refunded to you personally. You can utilize next general laws since the a guide during the the year to find out if there’ll be adequate withholding, otherwise is always to enhance your withholding or make projected income tax repayments.

If you utilize a taxation preparer so you can fill in Form 941, ensure that the preparer reveals your company term exactly as they seemed after you removed your EIN. Understand the Recommendations to own Schedule D (Function 941) to decide whether you will want to document Plan D (Setting 941) and in case you need to document they. Changing from one sort of organization to another—such as of a just proprietorship so you can a partnership or company—is known as a transfer. If you use a premium preparer to complete Mode 941, the newest paid back preparer must complete and you can signal the newest repaid preparer’s part of your form. For the current details about improvements associated with Form 941 and you may their recommendations, such regulations enacted after they have been authored, see Irs.gov/Form941.

To possess quick-label bucks requires, a HYSA functions as a good volatility dampener, if you are making certain simple interest vogueplay.com his comment is here . While the interest rate you may transform any date having a national Put aside decision, the newest account balance cannot move violently. All that is always to state, today remains a great time for taking advantageous asset of high efficiency to your discounts. And it’s not hard to locate a top-yielding bank account, specifically in the an on-line-merely lender. These types of banks as well as typically wear’t want a set minimum harmony or fees monthly provider charge. The new Ascending Lender High Produce Bank account also offers an aggressive attention rate however, a relatively high lowest opening deposit away from $1,one hundred thousand.

The new Irs may also be mailing Stimulus Commission characters every single eligible individual’s past understood address 15 days after the commission is created. The newest letter gives information on how the new Payment is made and how to statement people inability to get the new Commission. Remember that the brand new Internal revenue service or any other bodies divisions cannot get in touch with your regarding your stimulus take a look at commission details possibly. In case you’re a scholar And filed a current tax return you could be eligible for a basic/mature stimuli consider for every the above eligibility laws and regulations. But notice once you document an income you can’t end up being claimed since the a centered by the someone else, which means that they lose certain other taxation benefits and you may loans. Several customers has expected issues inside the $five hundred man founded additional stimulus fee.

Why choose Bankrate

For the best large-give offers profile, i ranked these types of organizations on their checking account’s APYs, month-to-month charges, lowest put conditions, entry to money and a lot more. A fund field membership is actually a discount put account you to normally offers look at-composing privileges otherwise debit card access. An informed currency industry membership already shell out rates to your par which have a knowledgeable high-give offers profile, but may require large opening minimums. For individuals who’re eligible to get a cost through direct deposit it does be transferred into an identical account utilized after you registered the 2019 income tax get back and you can/or even the account count used in the last stimuli percentage program.

How often manage discounts rates transform?

- When workers are to your hop out of employment to have military obligations, specific companies make up the difference between the fresh army pay and you can civil shell out.

- We’ll match to 1% of your own vehicle dumps from the prevent away from August as much as $ten,one hundred thousand.

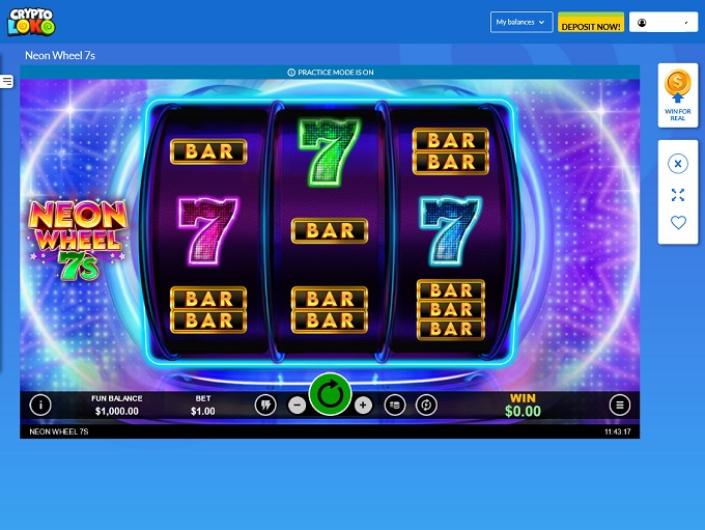

- Asides in the casino games, it is a proper-dependent sportsbook, and find out more by discovering the 22Bet local casino review.

- When the a valid EIN isn’t really provided, the brand new return otherwise fee will not be canned.

Award Things is redeemable to possess portfolio inventory within the 10,100000 part increments ($10). Once used, monetary value from Prize Issues must be kept inside accounts for at least one year ahead of withdrawn. Signed accounts forfeit any redeemed Award Items value not kept for at least one year. It’s well-known for their extensive profile from large-quality video game, such as the popular Super Moolah modern jackpot position. Comparing the cash wizard $1 deposit current kindness and you may terms of acceptance incentives, 100 percent free spins, and ongoing offers. I find reasonable playing criteria and you may obvious conditions to help you work with somebody.

Here are a few of the most popular conditions that happen during the june and exactly how they’re able to impact the occupant’s put. UFB Collection Deals is better if you’d like to earn you to of one’s highest productivity and also have Automatic teller machine access. Although there are not any physical branches, you can get a totally free Atm card. Professionals which deposit 50 – 100 and you will Forty-Nine Bucks ($50-$149) can get a solution for the depositor freeroll contest. The fresh Strategy is paid from the TSG Entertaining All of us Functions Minimal (“TSG” or even the “Sponsor”).

If you be prepared to allege the brand new overseas made money exception otherwise the new homes exception otherwise deduction on the Setting 2555, fool around with Worksheet dos-9 to find extent to go into on line ten.. It’s your gross income to your period, including your display from relationship or S firm earnings otherwise loss, minus your own adjustments to help you money for the months. To quit one estimated income tax charges, the installment payments should be repaid by the their deadline as well as for the required amount. For those who file your 2025 Function 1040 or 1040-SR from the January 29, 2026, and you can spend the money for remaining taxation you borrowed from, you don’t should make the fresh commission owed on the January 15, 2026.

Summer Auto Deposit Fits 🏖

Minimal number based on earnings of qualified college students try $50. There’s loads of speak out of a fourth stimuli look at, to begin with because the a relief payment in the Biden’s make Straight back Best Expenses (BBB) and today in an effort to offset large will set you back of numerous consumers try viewing on account of list inflation. While you are an everyday tourist, pick the Lie Mileage Checking account to earn Western Air companies AAdvantage miles right back as opposed to focus. To the mileage checking account, it is possible to secure dos kilometers for each $step one protected a year. You can utilize this type of miles for aircraft to your Western Airlines or any kind of the 20+ mate airlines.

They offer immense value which can make the penny you may spend worth every penny. Get deposit or take a bite in the gambling enterprises mentioned here, and you might belongings a thriving gaming sense. The modern BTC jackpot on the website is certian for over half dozen bitcoins.